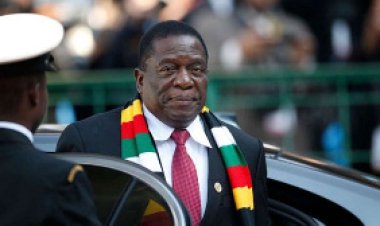

Newly redesigned naira notes were unveiled by President Buhari.

Buhari don launch di newly redesigned Naira notes.

Di event hold on Wednesday for State House Abuja.

Di President wey preside over di Federal Executive Council meeting bin hold di moni.

Wen old Naira notes go stop to circulate?

Central bank of Nigeria (CBN) go soon stop di circulation of di old ₦100, ₦200, ₦500 and ₦1000 Naira notes.

Dis na afta dem announce dia plans to redesign all di large Naira notes for di kontri.

Cbn Govnor Godwin Emefiele say di reason why dem dey change di notes na sake of request from federal goment.

Dem say di new currency to begin circulation from 15 December 2022.

According to di top Nigerian bank, di new and old currencies go still dey in use as dem go dey in circulation togeda until January 31, 2023.

As we dey move close to Cbn January 31 deadline dis na wetin you need know.

Wetin go happun to old notes afta January 31?

Di Cbn govnor, say old naira notes go comot for circulation afta January 31, 2023.

As soon as dat deadline pass dis na wetin dem say go happun.

Godwin Emefiele say, nobody go fit use di old design of di naira notes again as Nigeria no go recognise am as im money again.

Dis one mean say you no fit use di money buy anytin or do business as di money go turn worthless paper.

Anoda tin wey go happun na say, as e don turn worthless paper, banks go stop to collect di old notes patapata.

Which notes go still dey valid afta January 31?

Di notes wey go dey valid na di new ₦100, ₦200, ₦500 and ₦1000 naira.

Oda lower currency like ₦5, ₦10, ₦20 and ₦50 notes go still dey valid afta January 31 deadline.

Dem dey valid because Cbn no change di design of di polymer note.

Which notes go still dey valid afta January 31?

Di notes wey go dey valid na di new ₦100, ₦200, ₦500 and ₦1000 naira.

Oda lower currency like ₦5, ₦10, ₦20 and ₦50 notes go still dey valid afta January 31 deadline.

Dem dey valid because Cbn no change di design of di polymer note.

How to exchange old bank notes

CBN tell kontri pipo to deposit di old bank notes for bank.

Dem say deposits wey dey above ₦150,000 go attract charges.

Banks dey expected to keep dia currency processing centres open from Monday to Saturday.

All commercial banks wey currently get dis denominations of currency fit begin return di notes back to CBN wit immediate effect.

Why Cbn dey roll out new notes

Emefiele say di Cbn dey face problem wit di management of di current series of banknotes wey dey circulation, especially di ones wey dey outside di banking system for Nigeria.

E say currency management na key legal function of di bank, wey dey for Section 2 (b) of di CBN Act 2007.

Emefiele say one of di challenges dem dey face na say members of di public dey hoard banknotes.

E say data one show say ova 80 percent of di naira note wey dey for circulation dey outside di vaults of commercial banks.

Anoda challenge na say dirty and unfit banknotes dey for circulation and dis one dey give CBN bad image and e dey increase risk of financial instability.

CBN also tok say di currency wey dey for circulation dey increase risk of fake notes.

"For recent years, di CBN don record significantly higher rates of counterfeit especially for di higher denomination of ₦500 and ₦1000 banknotes," Emefiele tok.

E say according to global best practice, central banks suppose dey redesign, produce and circulate new currency every 5–8 years, but CBN neva redesign di naira for di past 20 years.

What's Your Reaction?